Being creative and working as a team are going to be key in how major suppliers and merchants, like Corney & Barrow, cope with wine buying shortages and over demand for classic regions such as Burgundy. But it opens up exciting new opportunities for alternative wines, regions and countries, says Richard Siddle.

“There is never a dull moment in wine buying,” says Rebecca Palmer when asked how things have gone so far in 2022. But even with all her experience she admits the wine gods have not been kind to anyone in the wine supply chain over the last couple of years, with seemingly bad harvests following each other around the world as frosts, droughts, storms and fires have only made the Covid pandemic worse.

Just when the world is crying out for more wine, there is less wine available to buy. Particularly from the key classic regions, such as Burgundy and New Zealand, that so often act like a barometer for the rest of the wine trade to take their readings from.

Rebecca Palmer says the pandemic, supply chain issues and global harvest shortages have made wine buying even more difficult over the last year

At a time of the year when wine buyers are used to having their heads in spreadsheets, finalising prices and negotiations in time for new wine lists and ranges in the spring, Palmer says she is equally concerned about having enough wine of the right quality and style to meet all Corney & Barrow’s customers’ needs, including the on-trade, private customers and its thriving e-commerce business.

Callum Robertson says the situation in 2022 is not dramatically different to what on-trade sales teams face every year. It’s just so much more acute. “We are always seeing price fluctuations and different volumes of wine available and we are constantly looking to find replacement grape varieties. That is something that we regularly do every year, it is just going to be even more demanding this year, particularly with the situation in Burgundy,” he explains.

That’s where the immediate concerns lie and the fall-out across the trade from the 2021 Burgundy harvest, which has been described as one of its worst – production wise – in history. The fact it comes on the back of a series of short harvests across the last two years has only made the situation worse.

For merchants, like Corney & Barrow, that rely so much on their Burgundy campaigns,it is proving to be a real challenge managing supply, demand and expectations.

The Burgundy challenge

“This year is a game changer,” says Palmer. Whilst in the past merchants have been able to find enough wines from the major producers, this year is different. There simply is not enough wine to go around.

The size and significance of the Burgundy category means it is not just a case of switching supply to another grape variety or region that might be possible in other areas of the wine list.

The Corney & Barrow team has to work together to find solutions at every quality and appellation level. Such is the complexity of Burgundy it has to find wines that can potentially replace a Grand Cru, or a Chablis from a certain appellation, or a particular style of Macon, and so on.

“You need to find alternatives for the whole region,” says Robertson. “From Grand Cru to Villages.”

Callum Robertson and the C&B sales team works closely with Rebecca Palmer and her buying team to ensure it is buying and sourcing the right wines

Palmer says the situation for the 2021 vintage is more severe for Chardonnay than it is for Pinot Noir. But everywhere you look, across all crus and appellations, there are producers that have effectively lost their entire crop.

“They are all having to draw on previous vintages to satisfy demand” she adds. “It is shocking how bad the situation is. But then it does depend on the producer and how far they can take a long-term view.”

The fact the 2020 and 2019 harvests were also short has just made what was “already a difficult situation a whole lot worse”.

Much now depends on the weather in the coming months and if the region can get through the all-important spring without suffering the huge frosts damage that hit so badly last year.

That will then help determine to what level producers will have to dig into old stocks and what prices they are going to be willing to release for the 2022 campaign and back vintages.

“The worry the Burgundians have for the next three months is that if it’s unseasonably warm in the next few weeks, and the vines start to leaf and bud early, then the risk of frost damage, typically in April, is huge. Though frost can happen up until what’s called the ‘saints de glace’ dates in mid-May, after which the Burgundians can reasonably feel the risk is over. If they do get another severe frost episode this year, like 2016 or 2021, then the stock shortages will go from chronic to disastrous.”

The only potentially good thing to come of out of the current Burgundy shortage, suggest Palmer, is the opportunity to taste and see some older vintages coming into the market. Such is the global demand for Burgundy that so much of its wines are sold straight away, when they’re really way too young, rather than giving the wines the time to stop, breathe and rest.

Slowing down sales

One key solution to the Burgundy crisis in 2022 is to literally slow down sales so there enough Burgundy wines available at all quality levels to buy all year round. To do that will require careful planning and making sure customers have enough “alternative” wines to sell, says Robertson.

“To mitigate against all this we have to bring in wines that are going to slow down the sale of Burgundy in key restaurants. That way we don’t lose the category and allow our customers to still have the most important and prized producers on their lists, but we can manage their sales by having other options on the list from other countries.”

Burgundy alternatives

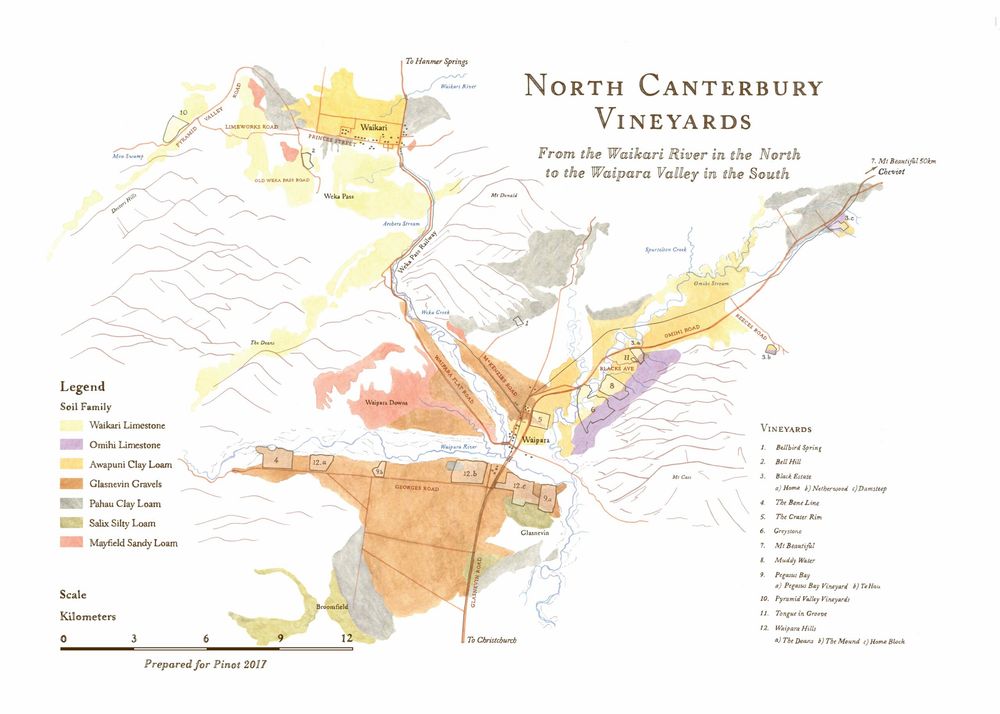

New Zealand may have had its own shortages but it is also proving to be a good alternative to shortages in Burgundy. Here’s some of the vineyards of Muddy Water Wines that Corney & Barrow is working with

So where do you go to replace top quality Burgundy at reasonable prices? Well, if you know where to look there are multiple sources says Palmer. The stand-out quality areas for Pinot Noir probably lie in New Zealand and Central Otago, in particular, so often described as the “new Burgundy” by sommeliers and buyers.

“You have to have Hawke’s Bay Chardonnay on the list as well,” says Robertson.

But whilst they might be natural replacements for experienced buyers and sales team, they are not the immediate go to areas for restaurant managers, their teams or their customers.

“Our challenge is to talk to the trade and help educate them about just why this Chardonnay from Hawke’s Bay, or, say, Adelaide Hills, is worth buying,” he says.

The key, adds Robertson, is to be able to talk about the wines with the same complexity and reverence as you would a top-class Grand Cru Burgundy with an understanding of its vineyard specific wines, the soil types, its terroir, the ageing complexity, or barrel selection, and so on.

He points to the producer Muddy Water Wines in Waipara in New Zealand that has carried out the same extensive soil analysis, mapping out the right parcels of vines and grapes to pick for its wines that the most famous producers in Burgundy might do. “They have got that great Burgundian twist to them and the same authenticity behind their wines,” he says.

A map showing the different soil types in North Cantebury where Muddy Water Wines has its vineyards

“We need to be able to explain how this wine is made in a Burgundian style even though it comes from the other side of the world,” he adds. “We can now talk to sommeliers about the quality of these wines and the fact they are available at often more affordable prices.”

He adds: “It depends on a customer’s knowledge and how adventurous they are and whether they might be ambitious enough to replace a Premier Cru Burgundy with Burgundian styles from elsewhere. For example, a top, barrel-fermented Hungarian Furmint, or a smart producer like Elephant Hill from Hawke’s Bay.”

It’s also where your knowledge of a customer comes to bear, he stresses. “You can judge what your customer wants to get from their Pinots and whether they would be happy moving to a more fruity alternative, or prefer something greener or more earthy. Then you can offer them different things. They are the ones that are talking to their customers and they know their taste profile and we can try and match with that.”

He adds: “It’s like wine Kung Fu. A stand-off between what they want and what we can offer them.”

Palmer likens it more to a Rubik’s Cube where there are certain parameters you have to get right for it work.

Looking to Germany

She says Germany and Alsace are increasingly a good option for sommeliers and buyers looking to find Burgundian alternatives. “There are Pinot Noirs (Spätburgunders) here with real class and structure – from the Pfalz, Rheingau, and other regions like Baden in the south, and from the length and breadth of Alsace too,” she explains. “The sales team then have the opportunity to show customers other styles from the same producers, such as a top dry Riesling such as a Grosses or Erstes Gewächs or an Alsatian Grand Cru.”

She adds: “The beauty of those German wines is that they also share a similar hierarchy to Burgundy so can be positioned as a more direct replacement up the quality ladder.”

Robertson says it can be hard to get customers to think as far afield as Germany if they have their heart set on a classic Burgundy, but it certainly opens up doors and opportunities for restaurants to try.

It is equally, adds Palmer, a great opportunity for some of the more emerging wine regions to get a “stronger foothold on certain wine lists” and it is an area she and her buying team are working hard to source. “It gives us a chance to showcase other regions and countries.”

Robertson agrees and says it is an opportunity to think outside the box and introduce completely new styles to customers that might be a more mineral, but also don’t have the rich, ripe fruits that any New World alternative might bring.

Rebecca Palmer working with the team at Chamuyo in Argentina to help blend its wines from the estate

Close teams

Just talking to Palmer and Robertson over Zoom you get a sense of the close team spirit that Corney & Barrow prides itself on. They may be working in different parts of the business, but they both share the same goals, and have similar challenges to overcome.

It certainly helps, says Palmer, that Robertson spent two and a half years working as part of the buying team, and instinctively knows what issues they are facing in sourcing the wines that he and the on-trade sales team want to offer their customers.

Robertson says he made the switch to sales some six years ago as he really likes to talk to the end customer about wine and be more hands on with the final sale, but also the follow-up service and being able to help them and their teams better understand the wines they are buying and selling.

“It is passing on that knowledge and giving them the tools to then go and sell the wine to their customers that I really enjoy,” he says.

For Palmer working with a sales team that also have buying experience is invaluable. “It’s great to have someone who has the wine geek side to them, but also has a real clear insight into wine buying and what that actually means,” she says.

Ambitious buying

Barta in Hungary has been a great new producer partner for Corney & Barrow in opening up varieties such as Furmint to its range

Crucially it gives Palmer and the buying team the knowledge and the confidence to go out and look to source wines they believe can be the next big thing and what sommeliers will be looking for on their lists in two, three or four year times.

She points to Furmint as a classic example of a style that is now ubiquitous on wine lists, but was very rare to find 10 years ago.

“Furmint is still a something of a rising star. It’s also a useful example of how we work at C&B. We look to build brand profile internally first, working to build excitement around and knowledge about our producers and their wines – in this case our agency Barta Estate, from Hungary. As a buying team we work closely to create a plan of action for our producers, aiming to bring them and their wines closer to the sales team, who can then position the wines with the right kind of customers. It takes time and care to do this well, to create a following, get traction. With our Hungarians and their Furmints, we’re now at that tipping point where the wines are motoring both in the on-trade and with private customers.

She adds: “That’s satisfying to see, and it’s the direct result of a huge amount of team-work end to end – producer, buying team, sales team, all working in tandem with the end customer.”

“We are always thinking ahead,” she says. “What can we be looking at now from certain suppliers that might be in the market three to five years from now. That’s what we did in Chile where we were able to work with a number of younger, terroir-driven winemakers to bring what are now seen as fashionable coastal and sustainable wines. And winemakers that were going back to some of the older, local, or so-called ‘heritage’ grape varieties.”

It’s also what really “excites” Palmer in her work. The chance to go out and explore and discover new wines and then come back to “talk to Callum and their team to see if we are on the right track”.

“There is always a sense of evolution going on here,” agrees Robertson. “Yes, we have all the prestige wines that we are well known for, but we are not just about those. What this shortage in Burgundy is doing is allowing us to go out and celebrate wines from elsewhere.”

The cool Chilean coastal wines from Eduardo Chadwick’s Errazuriz have really hit the mark for Corney & Barrow, says Rebecca Palmer

Eduardo Chadwick, of Errazuriz and his coastal Chilean wines from Arboleda in the Aconcagua Costa are also a great alternative, he adds, at a fighting price Bourgogne Blanc price point. “Taste Arboleda Chardonnay blind and it has all the freshness, acidity and complexity there.”

Palmer says you can certainly take the “if you like this, you will like that” approach to introduce new styles to your range. Again that’s where Furmint found its feet in the on-trade, and other ‘lesser-known’ heritage grape varieties like Albariño, Godello, Arneis, Falanghina, Pecorino… the list goes on

“Wine by the glass is also key in all this,” she adds. “People are always prepared to sample new wines that way. Perhaps by offering a glass with a specific dish. It’s a good way to upsell wines too.”

This is also a good time to go back to some old classics that have lost their way in recent times. Like Muscadet. Both Palmer and Roberston believe 2022 could be the year that Muscadet makes something of a come-back.

“Generally speaking the quality of Muscadet is far higher than in the past,” says Palmer. “It is such a misrepresented style, or rather perhaps: its reputation is glued to a past era, and it’s due a reboot, and that will come.. You can get some amazing Muscadets, more varied in style, both aromatically and texturally.

Robertson agrees: “We’re trying to get people to move back to Muscadet. We are loving the textural variety and briny freshness of these wines. Muscadet pairs so beautifully with seafood, which as a nation we seem to be eating so much more of now. It needs a twirl in the limelight, rather like Picpoul, that has a similar profile, and has become such a popular choice with consumers. Muscadet can be an alternative.”

Palmer says she has “things in the wings” that is looking forward to bringing to the market over the next year. “We’re hoping to bring in from wines from southern Italy, the Loire, Spain, the Jura, parts of central and Eastern Europe and Australia. So we have a lot of brewing.”

For Burgundy is not the only region where busy buyers are having to find short and long-term solutions.