Whilst The Buyer’s first two reports from Wine Paris have discussed in detail all the reasons why the show has fast become the global wine trade event with its 52,622 visitors, 54 exhibiting countries and an 80% increase on 2024 of international exhibitors, the question for those this side of the Channel is where does the UK now sit, with its challenging trading platform on the world stage?

Consumers don’t want to drink alcohol (globally), Trump 2.0 trade tariff wars are looming and UK buyers are having to explain the British trading landscape - with so many businesses reeling from national insurance rises, the unclear rules behind Extended Producer Responsibility (EPR), new health labelling for Ireland, hospitality and retail no longer able to absorb costs and, the complex higher alcohol tax regimes, not to mention the worst inflation the industry has seen in Q1, all pummelling business confidence.

“Absolutely,” is it still a great place to do business was the upbeat message from Miles Beale, chief executive of the Wine & Spirits Trade Association during a major debate on the geopolitical factors impacting the global wine industry.

Miles Beale, right, talking during the geopolitical debate at Wine Paris

“The UK alcohol duty rises have made everyone’s lives miserable. It’s a bad idea, painful and costly, but it’s happened. We need to put the chapter aside and decide, what we do next,” he told Wine Paris.

The UK, he added, remains a key global player, as the world's second largest wine importer by both volume (after Germany) and value (after the US). It imports 1.6 billion bottles of wine a year and exports 1.4 billion bottles of spirits.

But that’s a double-edged sword, warned Beale. It makes the UK “highly exposed” to market conditions. Previous tariff wars were “painful, the wine trade must prepare for a similar situation”.

Beale stressed: “Trump 2.0, tariffs are coming. It’s not a matter of if, but when. Trump is not going to bend the rules for the UK because his mother was Scottish.”

He added: “The UK needs to move fast. If we do nothing, we risk losing our position as a leading wine importer and spirits exporter…but it depends which way the UK government is going to swing - towards the US or Europe?”

UK buyers on the ground

Frances Bentley, wine buyer at LWC Drinks, said there was one big issue every producer wanted to talk about at Wine Paris - the new UK alcohol duty system and what was going to happen to their wines’ ABV levels. They wanted to understand how consumers are reacting to ABV levels and are trying to understand more about Extended Producer Responsibility, she added.

“When we explain EPR, they say: ‘But shouldn't it be the on-trade who pay for that?’ The view is that increasingly, the UK is seen as being quite backward and that the country was once famed for being not bureaucratic and less so on the nanny status. People are having a bit of a laugh at us, really.”

Boutinot's head of wine, Sean English, said its role was to educate the producer on the changes in legislation and trends in the UK: “They want clarity and with clarity comes opportunity as to where we target to place their wines.”

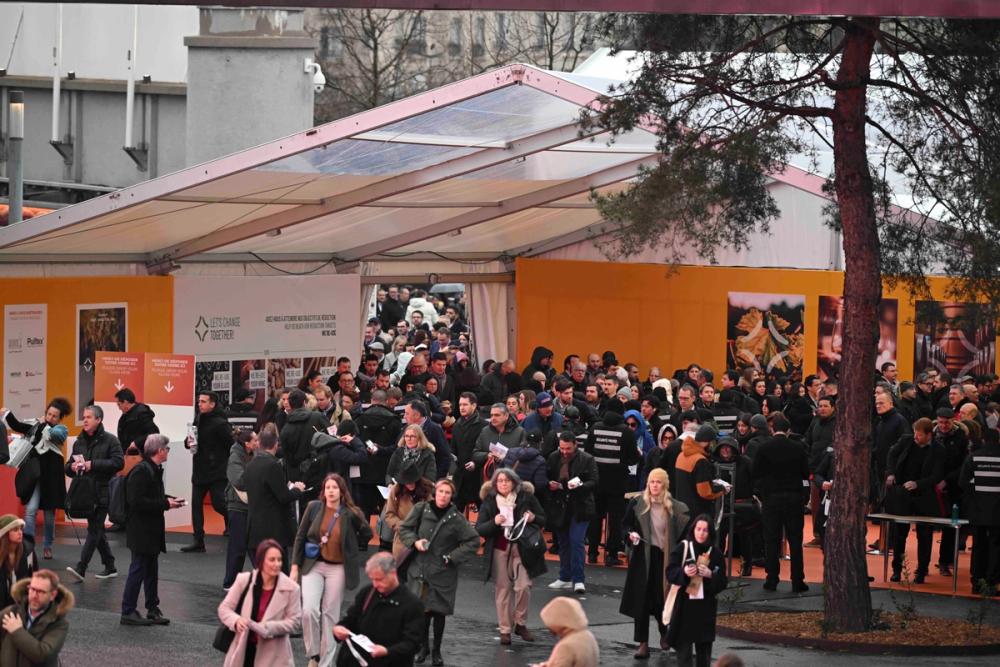

With 52,000 visitors there was an increased opportunity for buyers and producers to do serious business at Wine Paris

Nick Rezzouk at Reserve Wines added: “When I speak to the smaller producers, they see it as our problem to deal with. They’re just shocked when they hear the RRP on the other end. They say: ‘So, you are going to sell my wine for £25? That’s €13 in France. What are you guys doing?’ To them, if I am still interested in buying their wine and it makes sense for them from an RRP perspective, they don’t care what happens our end.”

Graham Crawford, sales director at Oakley Wine Agencies, which specialises in Portugal and Spain, said the bigger retailers have worked out their budget for a particular product and are now looking for value within “indigenous grape varieties, more experimental, more interesting wines”. He added: "What that means for us is regions like Tejo used to represent value for money and is now a premium wine. Rosés, sparkling and white grapes from Portugal seem to be the new trends.”

Richard Cochrane says despite market conditions in the UK Felix Solis was enjoying big jumps in sales and volumes

Richard Cochrane, managing director of Felix Solis, which this week announced an 85% volume increase for its Mucho Más Spanish wine brand and 18% growth for its Rioja brand, Castillo de Albai (Nielsen to 28/12/2024) was in a good position to talk about healthy the UK wine market is - if you have the right wines at the right prices.

He explained: “We still supply the top three brands in the UK’s Spanish top 10 and are seeing growth. It is getting harder. As an industry, we've got into bit of doom and gloom. I think it's probably time to be a bit more upbeat and look at the opportunities.

“The retailers were citing that they had to deal with duty, which is obviously the biggest financial stress, but they've also got some unclear costs coming in terms of EPR which still needs to be determined.”

But it is a similar challenge to what buyers have faced for at least the last 10 years: “There is a whole floor of lower cost to go for, but is that healthy? They would love price reductions but everyone's well aware of where costs are. These are industry wide consequences - to retailers, and producers in equal measure - because of the impact it has on consumer price. But if the price increases, we sell less,” added Cochrane.

WineGB was able to showcase some of the best wines coming out of England and Wales at the show

Finding wines at the right price is still the number one concern for buyers, stressed Paul Robinson, head of wine at Robinsons Brewery: “Producers have got to understand that our taxes are so high, we're paying close to £3 a bottle tax. If it's coming in over at €6, plus the tax you're at €8, and then we’ve got to start making the money and our 250 pubs want to make a margin. Suddenly a €6.50 bottle is £40-50. It’s just too expensive. But I am looking to do 30-40,000 tonnes of business.”

He said Romanian had positioned itself ideally for the UK market. “It is all screwcap, which is perfect, and the wines are really affordable. Some Italian and French producers have got to be careful, because, for instance, Pinot Grigio is Pinot Grigio whether it comes from Italy or Romania. We have already seen an uplift in Romanian wine sales. We recently chose a Pinot Grigio from Romania over Italy.”

French IGP wines were also of interest due to price points and style flexibility. “We have searched a lot for the right IGP wine,” added Robinson. “Chablis, though, at the right price, is harder to source due to shortage and high price points. But our customers want it.”

Rise in no and low

The no and low alcohol section at Wine Paris was bigger than ever but producers across the show were also promoting their no and low brands. Picture Philippe Labeguerie

At every turn no and low alcohol wines were everywhere, either as an extension to an existing range or a new launch - no matter the country or wine region. There was alsoa bigger self-pour no-low alcohol section at the show.

“I went last year and can see the size of it this year, but a lot of the products are totally wrong for us,” said Rezzouk at Reserve Wines. “Paying €30 for a non-alcoholic Champagne wanna-be is not giving me Champagne feelings. With regards to the still wine no-low alcohol category, technically speaking, it’s the most difficult challenge. It’s getting to be too much of a crowded market. It’s growing faster than my customers are asking for it.”

Bentley, with LWC being one of the first to bring Kamina, an 8% wine in partnership with South African Overhex Wines, to market said: “I think it’s going to be harder for producers to get away with a 14.5% ABV when they don’t need to be at that level. But if it’s premium wine, it’s still a premium wine. A lot of those wines, in order to be more palatable to the modern wine drinker are starting to lower their ABV anyway. Moldova and Hungary [for naturally lower alcohol wines] is what I have been looking at.”

Robinson certainly sees the future in non-alcoholic wines, but says quality at the right price point is even harder to find: “I get asked for them the whole time. I tasted the wines in the no-low area and pulled out two out of 50. Everyone is trying to have a go at this non-alcoholic thing, but they just whack loads of sugar in it and it’s awful. Sparkling and Aperol Spritz tended to fair better.”

He added: “I found a 0% fizz in the French hall which was quite good, but then they told me the price - €6.50 - and I fell off my chair. You’ve got to be joking. I’m starting at €2.50. All of their pricing was completely off spectrum.”

Cochrane said Felix Solis has been steadily reducing its 14% wines over the last four years using natural winemaking methods to ensure it does not lose taste or quality. “We are picking earlier, looking at our yeast selections and those sorts of things. We now have 10-11-12% wine brands in our range,” he said.

Impact of Wine Paris

The intenational side of Wine Paris was up 84% on 2024

Rebecca Ohayon Gergely, wine buyer at Majestic, said the international expansion of Wine Paris was making it even more “worthwhile to attend”.

Cochrane, though, felt the New World element was still relatively “underweight” given the scale of some of the other regions.

A thought echoed by Bentley at LWC Drinks: “There are still gaps in the range of producers exhibiting which ProWein can still fill.”

Reserve Wines’ Rezzouk added: “The New World is still quite small. The wineries on show are going to be the ones able to pay to exhibit. It’s got a long way to go before we start seeing the level of tiny producers we see in France.”

Crawford said: “Wine Paris has a vibe to it and it is definitely on the up as a show to attend. But in terms of business, I had two-thirds of my normal business meetings. The conversation would start with, ‘I’m not looking for anything new,’ begging the question, why are you here then? Portugal had a real buzz about it, Spain felt more challenging, a lot of people want to do more with Spain but outside of the likes of Rioja.”

Overall, he said it was “definitely a mixed bag of meetings. It’s becoming the retail price survival out there”.

More visitors, more producers, more halls and a big statement: Wine Paris 2025. Picture Jean-Bernard Nadeau

Lanchester Wines’ buying director Lesley Cook spent a day meeting suppliers and tasting new sparkling wines from its Champagne partner Champagne Moutard.

“There were quite a lot of different Malbecs from Argentina and Argentinian whites were showing really well. We had a ponder in California and it held a reasonable size of wineries. The quality from South Africa to France was really good. Lanchester is launching ‘on-trend’ orange wine at a lower entry level point later this year and has launched a crémant as everyone wants to drink sparkling these days but don’t want to pay the higher Champagne prices.”

Harry Crowther, wine buyer for Good Pair Days, said: "Everyone says Wine Paris is slowly becoming the best wine fair in the world. I say it has already arrived. Not only is Paris a much better hub for the event - in the sense that the city can absorb a serious trade fair without charging people through the nose for a hotel room - but the calibre of producers attending is now easily in line with ProWein.

"Don't get me wrong, I love ProWein and it is arguably still slightly more important for New World choice and exposure, but Paris just seems to have it all, and I can't see myself looking far past it if it continues on its current trajectory.”

In conclusion, Wine Paris has become a must attend event which Crawford, at Oakley Wine Agencies, sums up perfectly: “Attending Wine Paris is rather like being on a hamster wheel. You need to be inside the wheel to make it move. You have to be there and do the work and maybe nothing will come out of it straight away. Despite the challenges the wine industry showed a renewed sense of optimism despite the most unprecedented market conditions that we have ever found ourselves in to navigate.”

* You can read Part One of Richard Siddle's analysis of Wine Paris here and how it is now setting the global wine agenda.

* You can read Part Two of his analysis here that looks at the suppliers and producers offering new tarding solutions for buyers.