Over the last 40 years Hofmeister has known how to win the hearts and minds of the British beer buying public. Even if it spent nearly half that time not on sale at all. A recent poll, by Yonder, found it was the fourth most recognised brand by UK consumers in the premium world lager category. Its original TV advertising still features highly in any Top 100 TV adverts of all time listings.

The original George the Bear that became an iconic part of the 1980s and 1990s beer sector

That’s all down to the impact the brand had first time round in the early 1980s when Hofmeister’s infamous “George the Bear” supposedly came out of a Bavarian Forest to catapult it into the top five selling beers in the UK.

Now it’s back as a grown-up sophisticated beer, proudly fighting it out at the top of the fiercely competitive £4 billion UK world lager category, in its new revamped, relaunched guise as an authentic Bavarian slow-brewed Helles lager made in accordance to the 1516 German beer purity laws. As a brand it has been transformed from being one of the cheapest, mass volume beers on the market, to now proudly claiming to be the “most expensive pint on the bar”.

But it’s all very well being affectionately remembered and loved for what you have done before, if not enough people get the chance to see, taste and experience the new world-beating Hofmeister for themselves.

For whilst it is proud to be listed in a growing number of premium bars and outlets across the UK, including The Connaught and a number of Michelin star restaurants, the new Hofmeister team know if it is to truly take on the beer multinationals it needs to break out and find serious national distribution of its own.

Which is what makes the new sales and distribution deal with Keystone Brewing Group, so significant.

Spencer Chambers and Richard Longhurst the two entrepreneurs who bought the Hofmeister brand name of Heineken and re-invented it as an authentic Bavarial Helles Lager

“We believe our proposition is more powerful than it has ever been,” says joint chief executive, Spencer Chambers who, since acquiring the brand off Heineken in 2016, has, with business partner Richard Longhurst, been carefully seeding it into the most premium on-trade and specialist drinks retailers in the country.

He says Hofmeister has seen a 10-fold increase in revenue over the four years since the Covid lockdown and it has “been able to turn up the volume on the things that were working”.

But it was still "flattered to get the attention of a number of beer companies to be its national distribution partner".

The Keystone Brewery Group approached Hofmeister late last year. Formerly known as Breal Brewing Group, but rebranded in 2025, Keystone it is made up of Breal’s portfolio of businesses within the brewing industry, and has fast become a major player in the UK with its recent deals to acquire Black Sheep Brewery, the Purity Brewing Company and Fourpure, amongst others. While some of its initial deals saw the group rescuing businesses on the verge of closure, or taking them out of administration, in recent months it has broadened its approach to acquire prestigious brand licenses and distribution deals.

The Hofmeister deal is one such example. This is a straight sales and distribution partnership - similar to the one it signed earlier in the year with French cider brand, Sassy.

The new multi-award winning Hofmeister Helles lager - voted Best Lager in the world by the IWSC

Spencer says that for all the big steps Hofmeister has had made over the last eight years, its one challenge was “route to market”.

“This is a chance to turbo charge our distribution and have the people to then look after that distribution and growth as well.”

He adds: “We also appreciate Keystone is a disruptor in the sector. We are also a challenger brand in the world lager market where we are competing against behemoth brands. We are by nature disruptors and challengers ourselves and love that about Keystone.”

He adds: “We also thought there was a natural fit into their portfolio. We are big fans of Black Sheep and its attention to quality. We love the fact it has a great national ale brand as we are a national brand ourselves with distribution in England, Scotland and Wales. We also really appreciate the patchwork quilt effect of its national coverage of regional craft brands and premium French cider.

“For us to have a distribution partner whose huge gap in its portfolio was world lager was wonderful for us. There is a really nice fit between the two businesses.”

Keystone Brewery Group has bought a number of regional and national beer brands in recent years including the Black Sheep Brewery

Steve Cox, chief executive of Keystone Brewing Group, says of the new partnership: “Keystone is excited to welcome such an iconic, international beer brand to the group. There has been a gap in our portfolio for a world lager - and with its exceptional quality - Hofmeister is the perfect addition. World larger is one of the fastest-growing alcohol categories in the UK on-trade, and we know that consumers love Hofmeister’s brand heritage want to see more of it. As such, the deal supports our broader strategy of building a £100m portfolio of exceptional beer brands and beverages by 2028.”

Sales and distribution only

Under the deal Keystone will take control of Hofmeister’s direct sales across the on and off-trade and e-commerce, freeing the Hofmeister management team to focus on brand building and market execution.

Chambers says the timing could not be better as he believes Hofmeister is ideally placed to capitalise on the growth of the premium world lager market at a time when so many of its competitive set is, in his view, involved in a “race to the bottom” by attracting consumers through price and discounting brands such as Madri and Cruzcampo.

Yes, market conditions are amongst the toughest, if not the hardest they have ever been with increased, costs, inflation, national insurance, and now duty, but it is not the time for premium brands to blink, he argues.

In fact, the discounting actions of many of the volume world lager brands in the “middle ground of world lager” are leaving the premium word lager market open to brands, like Hofmeister, to demonstrate why it is worth spending a little bit more in order to truly experience a memorable night out with beers to match the occasion.

“Every time you go to the pub and buy a pint you can feel that inflation in the market and the price of a pint has gone up so much,” says Chambers. “But our argument is that the race to the bottom is happening in the middle ground of the world lager category, where most is actually brewed in the UK. But amongst the 100,000 hospitality retailers in the UK, there’s 30% of the most premium who are not trading on a race to the bottom on anything they do.”

The new look Hofmeister is brewed by Shweiger in the heart of Bavaria - here managing director Eric Schweiger gets into the action

He explains: “They are about elevating and providing value for money by offering a wonderful experience that you can’t wait to go and repeat. Our job, by providing them a truly world class beer and better quality product, is absolutely part of that.

“We have got a fabulous product and a wonderful brand, both of which are proving to cut through. Our proposition is to provide differentiation to the best on-trade retailers and give consumers a better experience and a better drink. All at a time when their costs are going through the roof and they need something which they can genuinely get behind, something which is worth more money, and can throw off more cash profit, in what is the on-trade’s largest drinks category - world lager.”

Premium push

Chambers believes there are lessons to be learned for premium brands in other drinks categories like wine and spirits. There is too much talk of price cutting, and a focus on lowering duty levels in order to squeeze more margin at the lower end of the pricing ladder.

The new look Hofmeister - all slow-brewed in accordance with the German 1516 purity laws

If you have a quality, premium brand then now is the time to put the foot down to deliver and explain those messages to consumers who are looking to spend a little more on that extra dining experience, argues Chambers. The chance to treat themselves, but only with products and in outlets they know can deliver what they are looking for.

The advantage the world lager category has over say wines and spirits, he argues, is you are only having to pay an extra 30p or so on your pint to have that quality experience, versus the price jump you would have to make between a supermarket brand and a premium wine or spirt.

“You are also getting a pint, you are not getting a single or a double or a glass of wine. But you are experiencing the exact same upgrade in quality of product.”

Heritage and authenticity

Whilst most of the competitive brands in the premium world lager market comes from what Chambers describes as “continental Europe” from countries with no strong beer heritage, Hofmeister comes from Bavaria - the birthplace of not just lager, but Helles lager that can only be made using three natural and local ingredients - barley, hops and water.

Its customers can be assured there are no “smoke and mirrors,” he adds. Hofmeister is a genuine, authentically brewed Helles lager direct from Bavaria.

What’s more the Schweiger brewery, that makes Hofmeister, not only has its own natural spring water well - which it uses to sell bottled water – but also sources it’s barley from local farms surrounding the brewery. It’s also one of the last remaining Bavarian breweries to have its own malthouse and sources its hops from the famous Hallertau region.

“This is a fourth-generation Bavarian brewery that has done nothing else but make great Helles lager with great experience and passion.”

The fact the Schweiger brewery is also one of five Bavarian breweries to be accredited for slow brewing means that Hofmeister is kept at 0% temperature for seven weeks, versus the standard few days for a world lager brand.

“We have the best ingredients, skills, knowledge, time and love to make the best quality Helles lager we can,” he says.

Follow the Bear

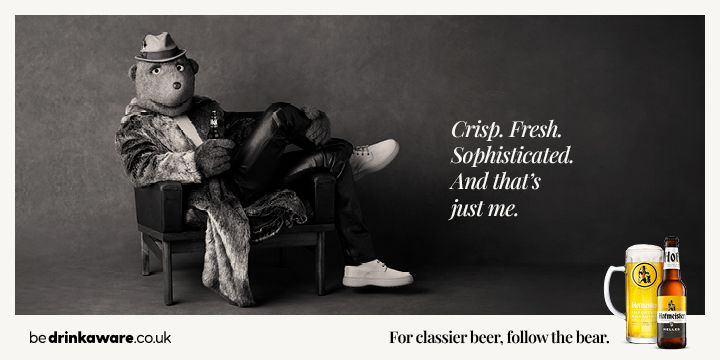

George the Bear has also grown up in keeping with the quality of beer - created by advertising agency BBH London

Hofmeister’s core demographic of 35 to 65-year olds is also the key market for world beers. An age group that not only has “a natural affection for the brand” but is excited about the opportunity to now taste the new Hofmeister that comes from where the original George the Bear was supposed to come from - the forests of Bavaria.

Which is why so much of Hofmeister’s marketing and brand building on social media has been about bringing back the famous George the Bear as a more grown up, sophisticated, mature bear. And is about promoting and emphasising the authentic and quality ingredients that go into the beer he supposedly drinks.

For this reason the new look George the Bear is such an important part of the Hofmeister brand’s revolution. Created by legendary advertising agency, BBH, behind such famous campaigns as Levi jeans and Audi’s Vorsprung Durch Technik, the new bear features a campaign photographed by portrait photographer, Charlie Gray, whose previous assignments had been with Robert de Niro and Ronnie Wood to name but a few.

The new look George the bear

Together Hofmeister and BBH have been able to build George’s new profile over the last couple of years with above-the-line advertising, including taking over the billboard in Piccadilly Circus, and full page adverts in the Financial Times, with further out of home campaigns expected this year and next.

All of which has seen Hofmeister achieve “category beating” engagement reach on social media, “way beyond what our competitors are achieving,” claims Chambers.

Figures from BBH show the Hofmeister social media, out of home and media campaign achieved:

- 6 million views.

- 494,091 impressions.

- +18,000% reach increase on Facebook.

- 192% increase in engagement vs period prior to launch.

- 376% increase in social interactions.

The new distribution deal will free Chambers, Longhurst and the management team to keep on building Hofmeister’s above-the-line activity as “owners of the brand”.

George the Bear took over Piccadilly Circus as part of his re-launch

Distribution challenges

The challenge for Hofmeister and its new Keystone distribution partners is to make sure any new listings come from the premium outlets that Hofmeister has targeted for growth.

The attraction of Keystone and the power of its distribution network is easy to understand but it also comes at a risk of relinquishing control of the final direct sale to existing and potential new customers.

Chambers says that that when you set out as a start-up you have no choice but to do things yourself and although it has got a lot of things right over the last eight years "naturally you make some mistakes along the way and learn from them too".

“When you do some things right then opportunities come along like this one and we are very excited to be in a position to take it,” says Chambers.

The pressure, though, is now on Keystone to deliver. This is a separate and new strategy to only manage the distribution of an independent brand. It has already had some early successes with its Maison Sassy and Big Drop distribution deals. If it succeeds it will no doubt attract other major distribution deals and help it achieve its £100m annual revenue target by 2028.

For Hofmeister it will be hoping it can achieve its sales targets in the premium on-trade and specialist independent wine merchants and use that to then “unlock an ability to grow the brand” in the premium off-trade as well.

Get that right and it will be on course to hit its target of tripling current revenues in the next few three or four years.

Which will mean a lot more beer drinkers will have taken up its 40 plus years invitation to “Follow the Bear”.

* You can find out more about Hofmeister at its website here.

* You can find out more about Keysone Brewing Group here.